Hey there! Have you ever considered the impact of mental health on your financial decisions, especially when going through the Rocket Mortgage FHA Loans process? Taking care of your mental well-being is crucial during this time, as the stress of navigating through loans and mortgages can often take a toll on your mental health. It’s important to prioritize self-care and seek support when needed to ensure a smoother and less overwhelming experience. Let’s delve into why mental health care plays a significant role in the Rocket Mortgage FHA Loans process.

Understanding Rocket Mortgage FHA Loans

Rocket Mortgage offers FHA loans which are backed by the Federal Housing Administration. These loans are popular among first-time home buyers because they require a lower down payment and have more flexible credit requirements compared to conventional loans. FHA loans are a great option for those who may not have perfect credit or a large down payment saved up.

One key feature of Rocket Mortgage FHA loans is the low down payment requirement. With an FHA loan, you can put down as little as 3.5% of the purchase price of the home. This can be a significant advantage for those who may not have the funds for a larger down payment. It allows more people to become homeowners and start building equity in their homes sooner.

Another benefit of FHA loans is the flexibility in credit requirements. While conventional loans may require higher credit scores, FHA loans are more lenient. Borrowers with lower credit scores may still qualify for an FHA loan. This makes homeownership more attainable for those who may have had financial struggles in the past.

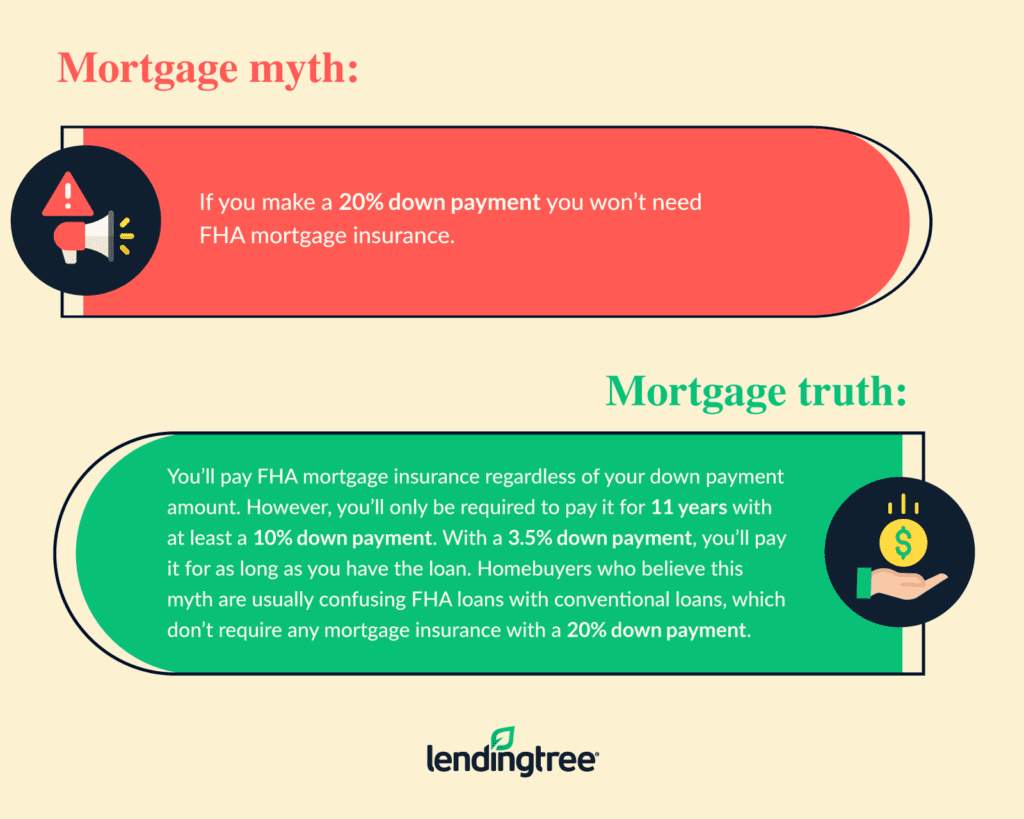

One important thing to note about FHA loans is the mortgage insurance requirement. Because FHA loans are backed by the government, borrowers are required to pay mortgage insurance premiums. This additional cost helps protect the lender in case of default. While this can increase the overall cost of the loan, it is a necessary requirement for those who do not have a large down payment.

Rocket Mortgage makes the FHA loan application process easy and convenient. You can apply for an FHA loan online through their website or mobile app. The online platform guides you through the application step by step, making it simple to provide all the necessary information and documentation. Rocket Mortgage also offers personalized loan options based on your financial situation, making it easier to find the right FHA loan for you.

In conclusion, Rocket Mortgage FHA loans are a great option for those looking to purchase a home with a lower down payment and more flexible credit requirements. The ease of the application process and personalized loan options make it a convenient choice for first-time home buyers. Consider exploring Rocket Mortgage FHA loans if you are in the market for a new home and may not qualify for a conventional loan.

Advantages of Rocket Mortgage FHA Loans

Rocket Mortgage offers an array of benefits for individuals seeking FHA loans. Here are some advantages to consider:

1. Low Down Payment: One of the main advantages of Rocket Mortgage FHA loans is the low down payment requirement. With as little as 3.5% down, borrowers can purchase a home with less cash upfront compared to conventional loans, which typically require a 20% down payment. This makes homeownership more accessible for first-time buyers or those who may not have substantial savings.

2. Flexible Credit Requirements: Rocket Mortgage FHA loans are known for their flexible credit requirements. While conventional loans may require a higher credit score for approval, FHA loans are more lenient and cater to borrowers with less-than-perfect credit. This can be particularly beneficial for individuals who have had past credit issues but are working towards rebuilding their credit.

3. Competitive Interest Rates: Rocket Mortgage offers competitive interest rates for FHA loans, making it an attractive option for borrowers looking to save on their mortgage payments. By shopping around and comparing rates, borrowers can find a loan that suits their financial needs and goals.

4. Government Backing: FHA loans are insured by the Federal Housing Administration, which provides lenders with added security against borrower default. This government backing allows lenders to offer more favorable terms and conditions, such as lower down payments and relaxed credit requirements. Additionally, FHA loans are often more accessible to individuals with lower incomes or less savings.

5. Streamlined Application Process: Rocket Mortgage offers a streamlined application process for FHA loans, making it easier and more convenient for borrowers to apply for a mortgage online. With a user-friendly platform and digital tools, borrowers can easily submit their documents, track their application status, and communicate with their loan officer throughout the process.

Overall, Rocket Mortgage FHA loans provide a range of advantages for borrowers looking to purchase a home with a low down payment, flexible credit requirements, competitive interest rates, government backing, and a streamlined application process. By considering these factors, individuals can make an informed decision about whether an FHA loan is the right choice for their homeownership journey.

Eligibility Requirements for Rocket Mortgage FHA Loans

When it comes to securing a Rocket Mortgage FHA Loan, there are specific eligibility requirements that must be met in order to qualify for this type of loan. Here are some key factors that lenders typically consider:

1. Credit Score: One of the most important eligibility requirements for a Rocket Mortgage FHA Loan is having a minimum credit score of 580. However, if your credit score falls between 500-579, you may still be eligible for this loan, but you will need to make a higher down payment.

2. Income Verification: Lenders will also assess your income to ensure that you have a stable source of income to make monthly mortgage payments. You will need to provide pay stubs, tax returns, and other financial documents to verify your income.

3. Debt-to-Income Ratio: Another important eligibility requirement is your debt-to-income ratio (DTI). This ratio is calculated by dividing your total monthly debt payments (such as credit card bills, student loans, and car payments) by your gross monthly income. Lenders typically prefer a DTI ratio below 43%, although some may accept higher ratios depending on other factors such as credit score and down payment amount. It is important to have a low DTI ratio to show lenders that you can manage your debt responsibly and afford your mortgage payments.

Overall, meeting these eligibility requirements for a Rocket Mortgage FHA Loan can increase your chances of approval and help you secure the financing you need to purchase your dream home. It is important to carefully review the requirements and gather all necessary documents before applying for this type of loan.

How to Apply for Rocket Mortgage FHA Loans

Applying for a Rocket Mortgage FHA loan is a straightforward process that can be completed online or over the phone. Here are the steps you need to follow:

1. Research and preparation: Before you start the application process, it’s important to gather all the necessary documents to support your application. This includes your proof of income, tax returns, bank statements, and any other relevant financial information. Make sure you also have your identification documents handy, such as your driver’s license or passport.

2. Online application: You can start the application process for a Rocket Mortgage FHA loan on their website. Simply fill out the online form with your personal and financial information, including details about the property you are looking to purchase or refinance. You will also need to consent to a credit check as part of the application process.

3. Speak with a loan officer: Once you have submitted your online application, a loan officer will reach out to you to discuss your application further. They may request additional information or clarification on certain aspects of your application. This is also an opportunity for you to ask any questions you may have about the loan process or terms.

4. Underwriting and approval: After you have completed the online application and spoken with a loan officer, your application will move to the underwriting stage. During this phase, the lender will assess your financial situation, credit history, and the property you are looking to purchase or refinance. They may request additional documentation or clarification on certain aspects of your application. Once the underwriting process is complete, the lender will issue a decision on your loan application. If approved, you will receive a loan estimate detailing the terms of the loan.

5. Closing on your loan: If your application is approved, the final step is closing on your Rocket Mortgage FHA loan. This involves signing the necessary documents and paying any closing costs or fees. Once all the paperwork is complete, the funds will be disbursed to complete the purchase or refinance of your home.

Overall, applying for a Rocket Mortgage FHA loan is a relatively straightforward process that can be completed online or over the phone. By following these steps and being prepared with all the necessary documentation, you can increase your chances of a smooth and successful loan application process.

Tips for Managing Rocket Mortgage FHA Loans

Managing Rocket Mortgage FHA loans can be a smooth process if you follow these simple tips. With proper planning and organization, you can ensure that your loan stays on track and avoid any potential pitfalls. Here are five tips to help you manage your Rocket Mortgage FHA loan:

1. Stay organized: Keep all of your loan documents in one place and stay on top of deadlines. Make sure to review your loan terms regularly and communicate with your lender if you have any questions or concerns.

2. Budget wisely: Create a budget that includes your mortgage payment, as well as other expenses like utilities, insurance, and property taxes. Stick to your budget to ensure that you can make your monthly payments on time.

3. Monitor your credit: Your credit score plays a significant role in your ability to qualify for a mortgage loan. Keep an eye on your credit report and make sure to address any errors or negative items promptly. Paying your bills on time and keeping your credit utilization low can help improve your credit score.

4. Communicate with your lender: If you experience any financial difficulties or anticipate a change in your income, contact your lender immediately. They may be able to offer solutions such as loan modification or forbearance to help you stay on track with your payments.

5. Build an emergency fund: Unexpected expenses can arise at any time, so it’s essential to have an emergency fund to cover them. Aim to save at least three to six months’ worth of living expenses in a separate account to ensure that you can continue to make your mortgage payments if needed.

By following these tips, you can effectively manage your Rocket Mortgage FHA loan and achieve your homeownership goals. Remember to stay proactive, communicate with your lender, and make sure that you are financially prepared for any unexpected expenses that may come your way. With proper planning and organization, you can navigate the process smoothly and enjoy the benefits of owning your own home.

Originally posted 2025-01-13 10:00:00.